How Much is PTA Tax on iPhone in Pakistan?

If you are planning to buy an iPhone from abroad or through the open market in Pakistan, you must have heard about the PTA tax on iPhones. Many new buyers ask: “How much is PTA tax on an iPhone in Pakistan?” or “Do I need to pay PTA tax if I bring an iPhone from Dubai or the US?”.

This guide gives you a clear breakdown of iPhone PTA tax in Pakistan 2025, how you can check your device’s status, and what it means for everyday users.

Why Do You Need to Pay PTA Tax on iPhones?

The Pakistan Telecommunication Authority (PTA) regulates mobile phone registration through the DIRBS system (Device Identification Registration and Blocking System).

If your iPhone is not registered with PTA, you won’t be able to use local SIM cards. To activate it, you must pay the official PTA tax depending on your model.

How to Check PTA Tax for Your iPhone

Users often search “How to check PTA tax on iPhone in Pakistan”. Here are three quick methods:

1. SMS Method:

- Type your IMEI number and send it to 8484.

- You’ll get an instant SMS about your phone’s PTA status.

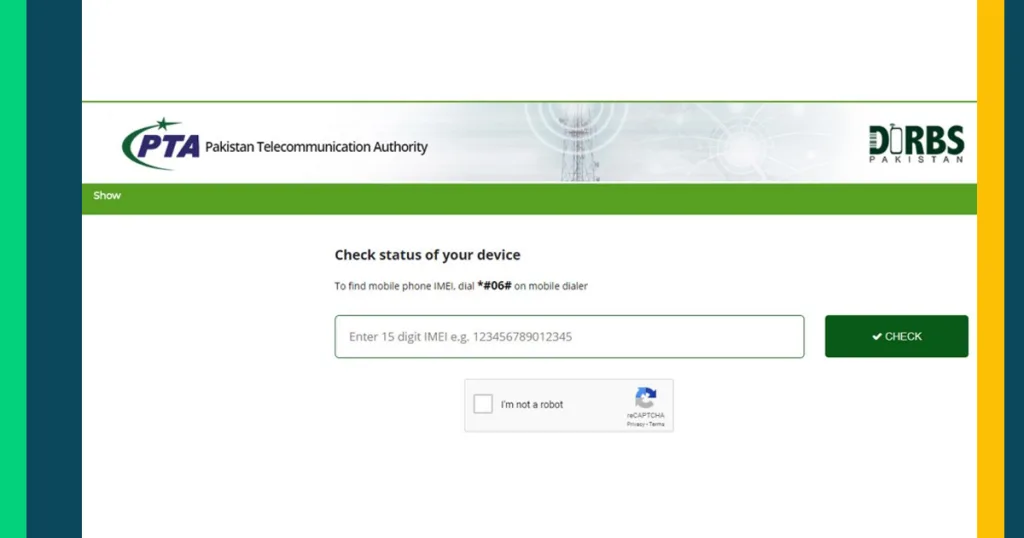

2. DIRBS Website:

- Visit the official PTA DIRBS portal.

- Enter your IMEI and check if your iPhone is registered or not.

3. Mobile App (DIRBS):

- Download the PTA DIRBS app from Google Play or App Store.

- Enter your IMEI and view details.

Pro Tip: You can find your iPhone’s IMEI number by dialling *#06# or checking in Settings > General > About.

Latest PTA Tax on iPhones in Pakistan (2025)

The iPhone PTA tax rates vary depending on whether you register through Passport or CNIC.

Here’s an estimated PTA tax for iPhones in Pakistan 2025:

| iPhone Model | PTA Tax (Passport) | PTA Tax (CNIC) |

| iPhone 15 Pro Max | PKR 125,000–130,000 | PKR 135,000–140,000 |

| iPhone 14 Pro Max | PKR 115,000–120,000 | PKR 125,000–130,000 |

| iPhone 13 Pro Max | PKR 105,000–110,000 | PKR 115,000–120,000 |

| iPhone 12 Pro Max | PKR 95,000–100,000 | PKR 105,000–110,000 |

| iPhone 11 Pro Max | PKR 80,000–85,000 | PKR 90,000–95,000 |

(These are approximate rates. Always verify on the PTA DIRBS portal before payment.)

How to Pay PTA Tax for iPhone in Pakistan

Paying PTA tax is now easier than ever:

- Log in to the PTA DIRBS website.

- Enter your CNIC / Passport number and IMEI.

- The system will show the exact tax amount.

- Pay through online banking, ATM, Easypaisa, JazzCash, or 1Link partner banks.

- Once payment is confirmed, your iPhone will be registered in 24–48 hours.

Frequently Asked Questions (FAQs)

No. Unregistered iPhones will only work on WiFi, not with SIM cards.

Because iPhones are imported luxury devices, the tax includes customs duty + PTA registration fee.

Yes, you can. Many travellers use their passport allowance to register iPhones at lower rates.

No. Only phones brought under the duty-free baggage allowance (one device per year) are exempt.

Final Thoughts

The PTA tax on iPhones in Pakistan is a mandatory step if you want to use your device with local SIMs. While the tax may seem high, it ensures legal import, discourages smuggling, and supports Pakistan’s economy.

Before buying an iPhone, always check the exact PTA tax through DIRBS. This way, you won’t face unexpected costs after purchase.